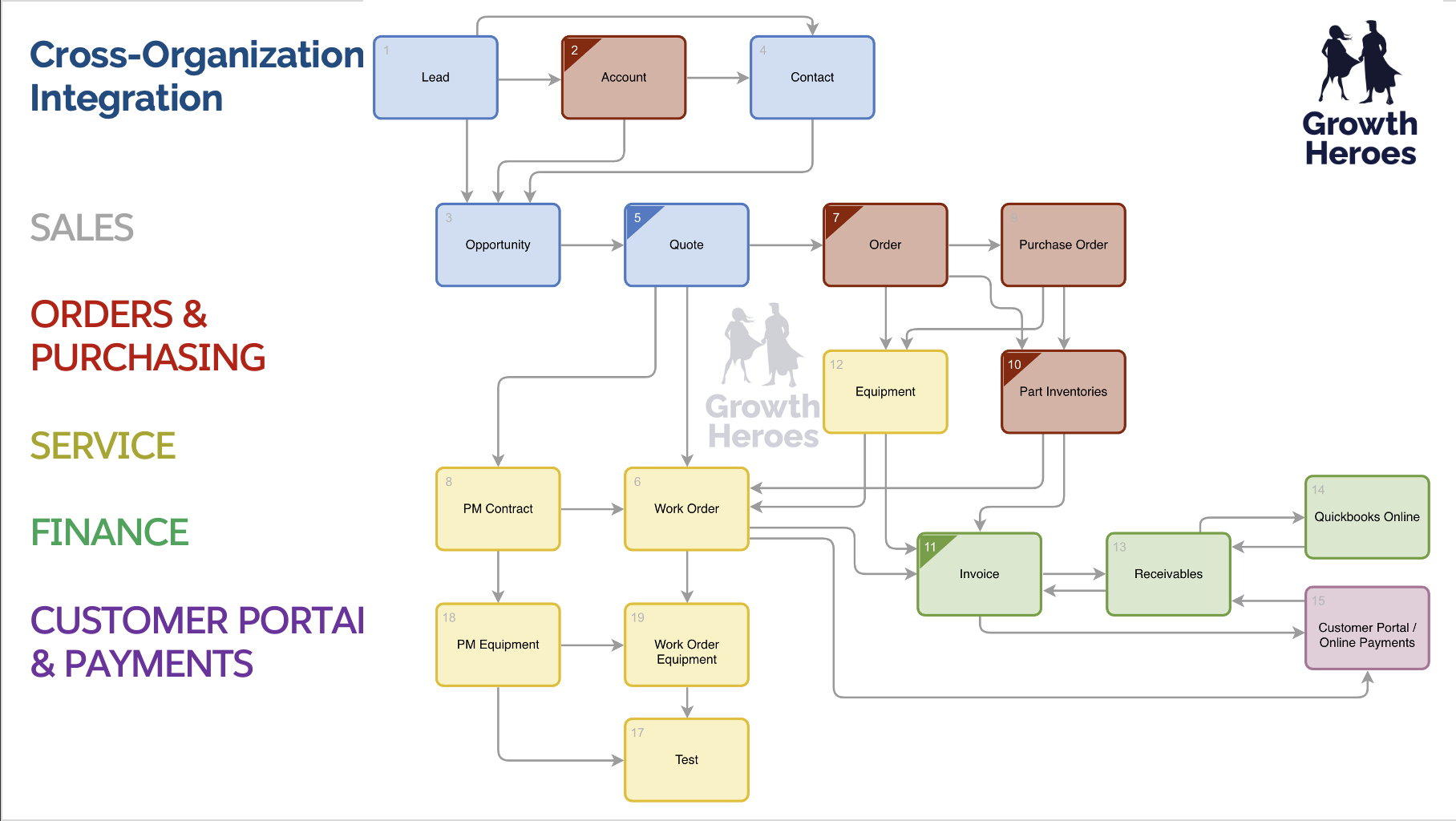

If you don’t connect your sales all the way to finance, you’re missing out on an opportunity to help grow profitability and scale your business. We’ve broken down the highlights from Jim’s talk for you.

When presented with a problem to solve, or a solution to architect, always begin with the end in mind. What is the ultimate goal? In this case, our goal is getting to an invoice – more particularly a closed, paid invoice.

Before you begin, it’s important to step back and think about how you’re actually getting paid:

- What accounting system does your company use?

- What do your invoices look like?

- How do your customers pay you? By eCheck? Credit card?

- Do they expect an email with a link to the invoice or do they require you attach a PDF to the email so their internal system can peel off that PDF and put it in their system?

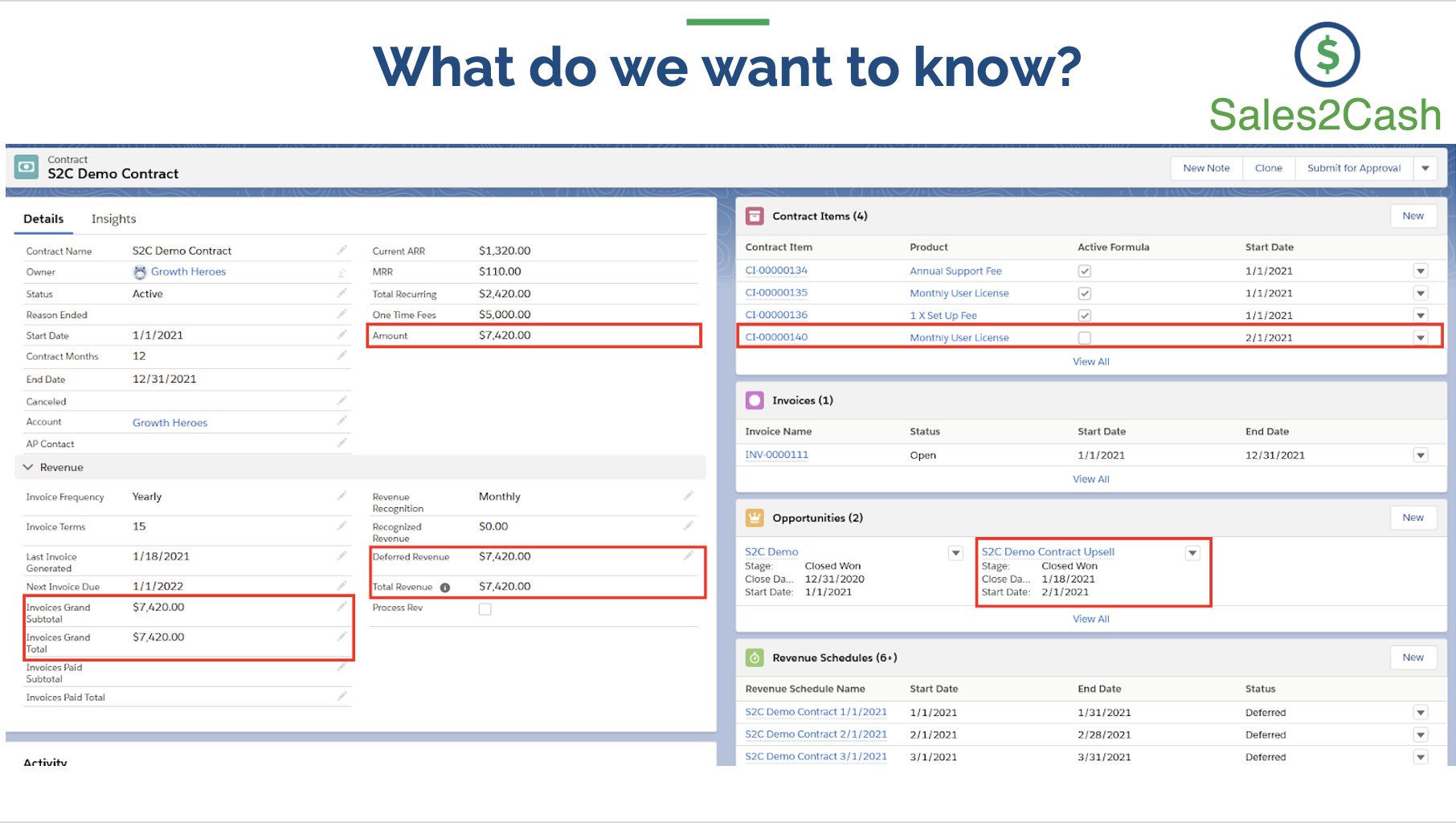

Because the goal is to scale the company and grow profitability, we need to determine what exactly we want to know that will help us in those areas. For a one-time non-recurring business model, you’d be interested in:

- Gross Revenue

- Cost of Goods Sold (CGS)

- Net Revenue

- Commission Splits

- Sales Tax

On the recurring revenue/SaaS side, you would want to track:

- Monthly Recurring Revenue (MRR)

- Annual Recurring Revenue (ARR)

- Net MRR

- Net ARR

- Year 1 Value

- Annualized Contract Value (ACV)

- Revenue Recognition (ASC 606)

One important thing to point out is that you can track margin in Salesforce – so you can see on your one-time and recurring revenue how much it costs to maintain and build that software product vs. how much you’re selling it for. Or you can also use margin to help ensure that your sales reps don’t discount too deeply to a customer. It’s valuable to look at margin on invoices, whether it’s one-time or recurring.

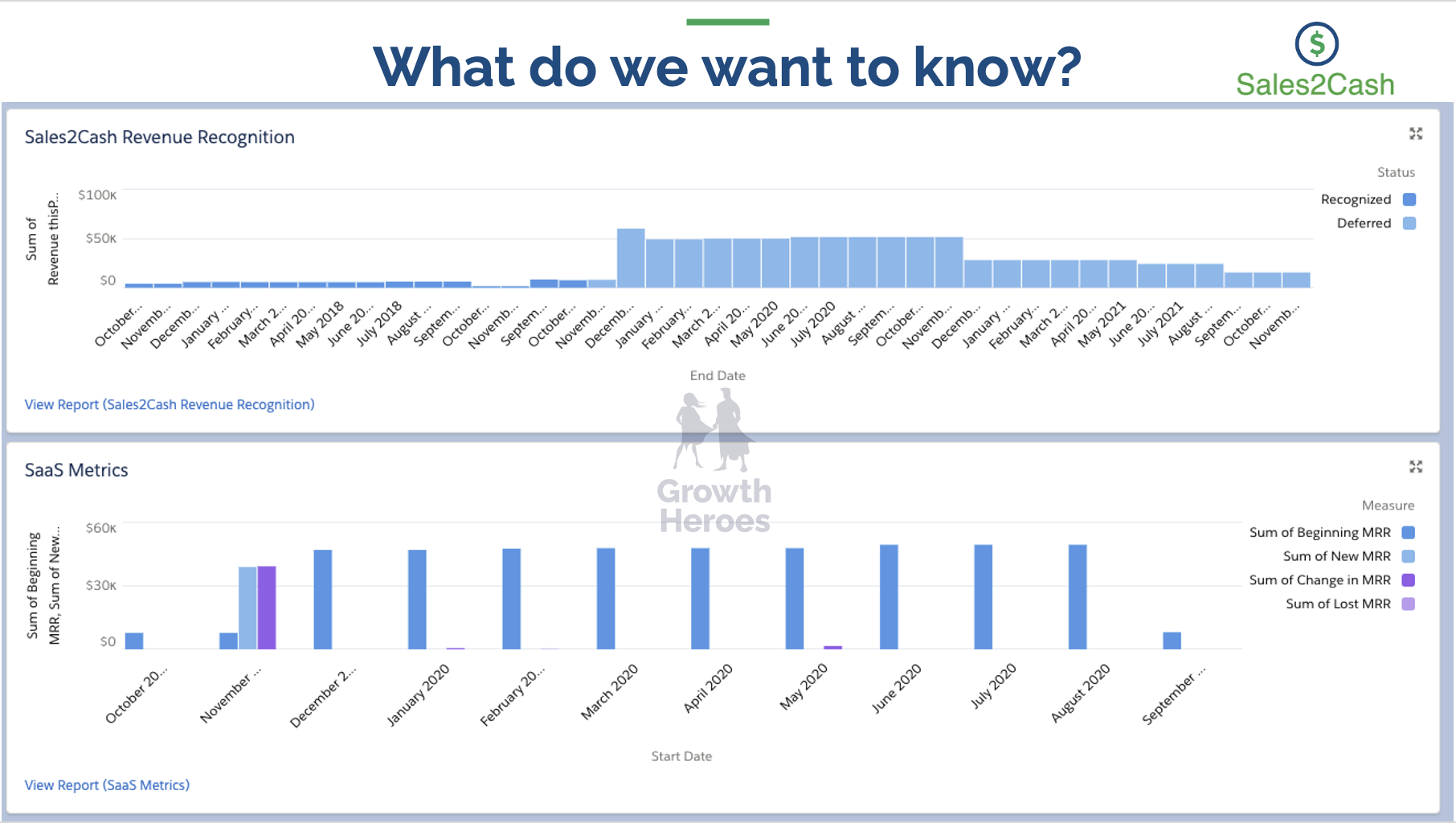

Ultimately, for SaaS, one of the most important things to know is what your recurring revenue looks like, what does that forecast show? Sales2Cash is an app developed by Growth Heroes that allows you to see this information at a glance.

Again, at Growth Heroes we believe that it’s incredibly powerful to think through your entire process – from a lead to a paid invoice that went to a customer, came back and went into the accounting system. This provides a lot of metrics that help you shape the company’s growth and work with executives on margins. And it’s difficult to get this metric data in Salesforce if you don’t have the invoice, margin, and the commission in Salesforce.

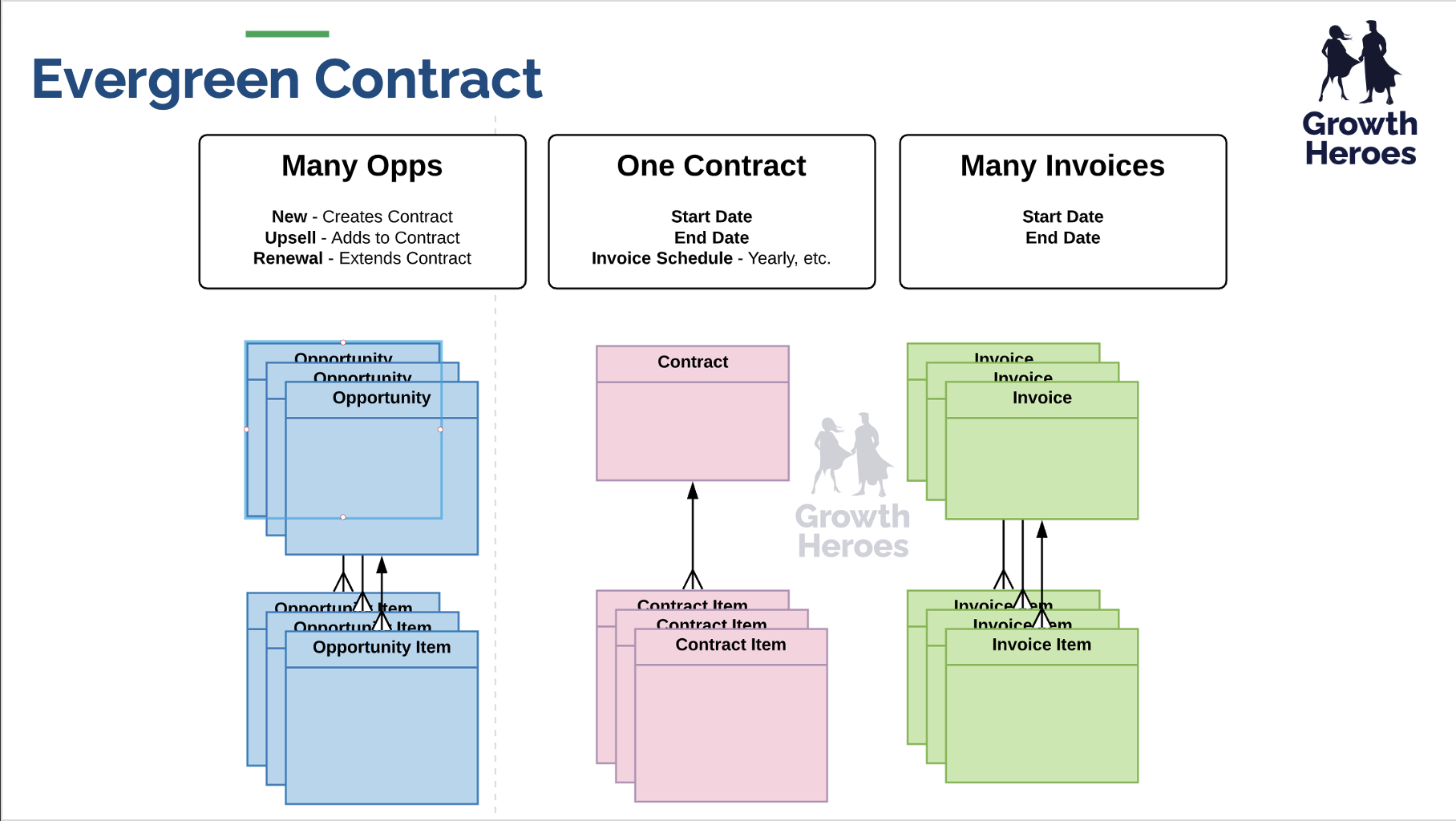

As you get into recurring revenue or evergreen contract models, there are many different ways you can organize your opportunities, contracts, and invoices. Jim is a firm believer in, as long as you have an overarching Professional Services Agreement, having many opportunities and many invoices that fall under one contract. This allows you to easily see the lifetime value of a contract and just update the contract as new opportunities come to light.

Lastly, if you would like to do sales tax in Salesforce, Jim says Avatax is the way to go. Avatax receives real-time, live sales tax updates for most states so your tax rates on your opportunity and line items will always be accurate. It also has solutions for remittance and Nexus and will help you set up Nexus, and can even remit your payments to the state automatically on your behalf.

As you think about streamlining your process, there are several options you can choose to make it easier on yourself. Some of these solutions are:

- Sales2Cash

- FinancialForce

- Salesforce CPQ

- Salesforce billing

- Accounting Seed

To learn more about tracking won opportunities to invoices within SFDC, check out Jim’s full talk here.

If you’re interested in learning more about Sales2Cash and how it can help to streamline your recurring revenue processes, we’d be happy to schedule a demo with you. Contact us to set up your demo today!